This is a summary of my first taste of MEV (if you can call it that), where I "competed" with other bots to receive a fee for providing a service to boo stakers. But before we continue, I think we should lay out some terms and definitions. What is MEV?

The definition of what MEV encompasses within the EVM world can be debated, as even the name itself is not well established (is it miner extractable value, or maximal extractable value??). However, I'll go with the following definiton: MEV refers to the maximum value that can be extracted from block production in excess of block rewards and gas fees, by including/excluding/changing the order of transactions in a block. This is a cool website on MEV.

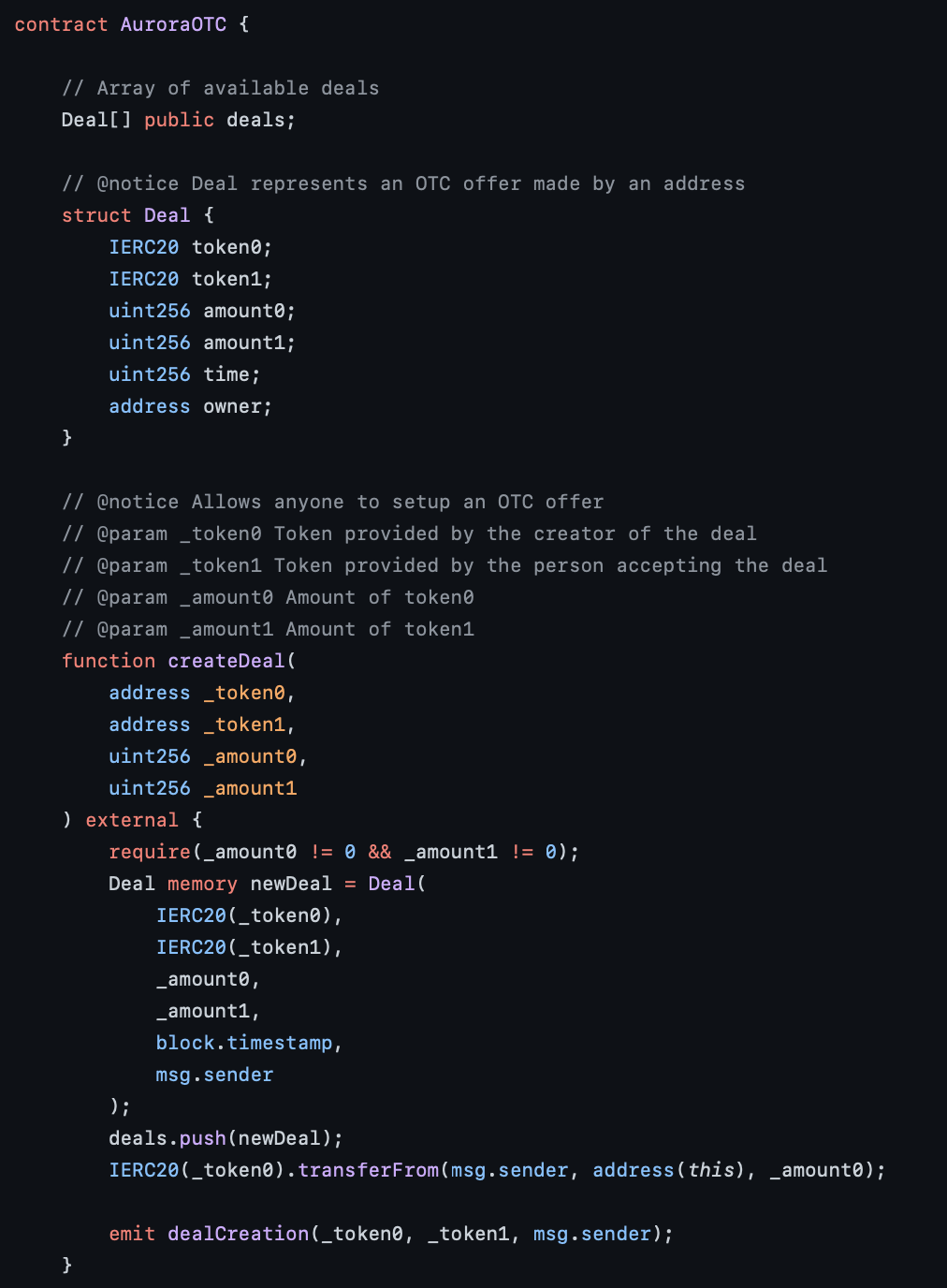

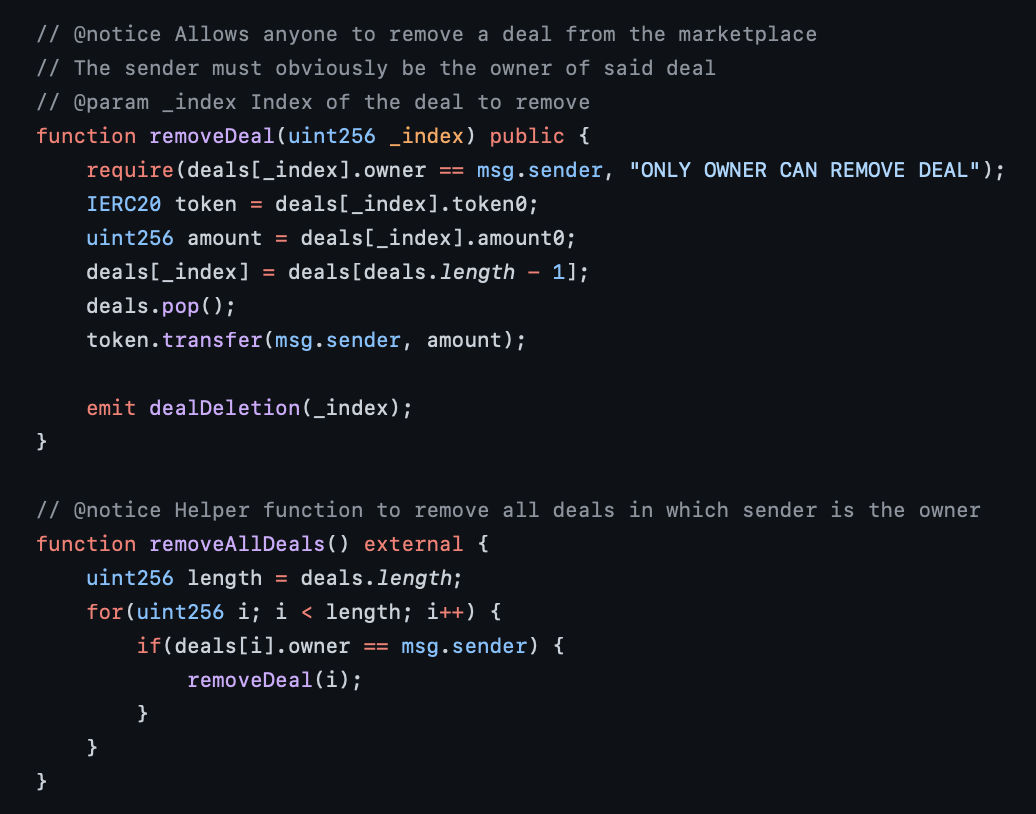

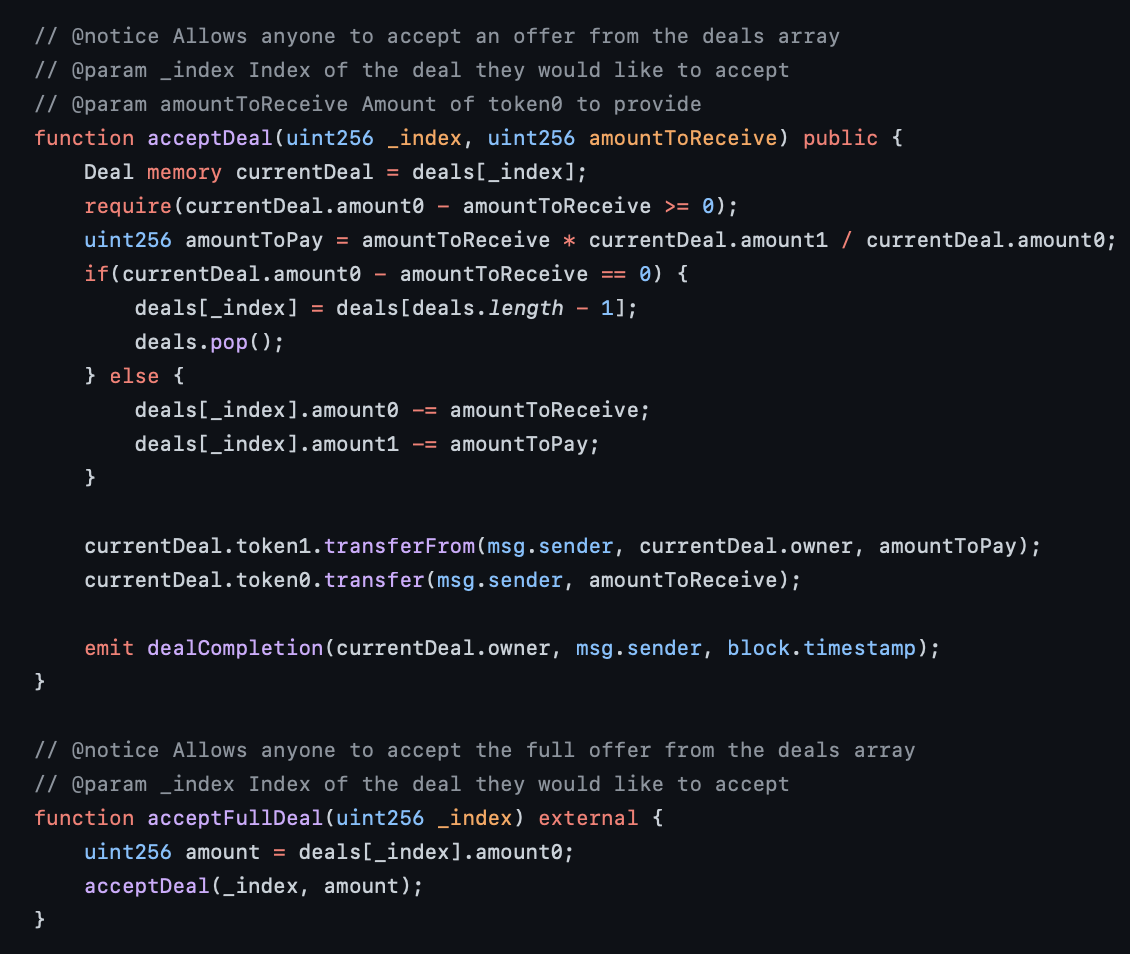

Next term, DEX (decentralised exchange). An exchange is fairly simple to understand - as the name implies it is a place where buyers and sellers meet to exchange stuff, in this case cryptocurrencies. So what makes a decentralised exchange unique from a centralised one. Simply put, the latter is facilitated by a single intermediary, which by nature will give them extraordinary power. In addition, they use what's known as a CLOB (central limit order book), which are too complicated for your average joe to participate in as a market maker. On the other hand, DEXes implement a different design known as an AMM, which allows anyone to participate in as a liquidity provider with the click of a button. With those out of the way, let's get into my amazing MEV experience.

To give a bit of context, I had just read this article on how a well know DEX called Trader Joe's had been exploited for hundreds of thousands due to a vulnerability in their fee converter contract. So, what exactly is this fee converter contract? To explain that we need to understand what providing liquidity means. At a very high level providing liquidity means you deposit your assets in a pool to facilitate others to trade between those assets, and you, the liquidty provider, are simply happy to take the other side of every trade. Why would anyone want to do this? Well, for starters you receive a percentage fee on every trade that occurs against your pool. In addition, you will also receive the native token of the exchange. This native token can have multiple purposes, but the common use cases are governance power in the decision-making of the protocol, and receiving part of the revenue of the protocol (generated through fees - it doesn't all go to liquidity providers). More on liquidity providing here.

We're specifically interested in the process by which fees generated by the protocol are distributed to the holders of the native token of a DEX. Again, staying at a high level, users are able to stake these tokens (meaning deposit in a contract). They then own a share of the number of tokens in that contract. The next step in the process, is the following, the protocol starts generating fees from every swap, these fees being in the form of LP (liquidity provider) tokens, which will all be sent to the same place - the converter contract, whose sole purpose is to convert these lp tokens into the native token. It then sends the native token to the staking contract, hence increasing the number of tokens in it, meaning your share now represents more tokens. Hence, as a user the workflow is pretty simple, you just stake the token, and watch the number of tokens you have go up (the value of each token could of course decrease, meaning this strategy is by no means risk free).

Long story short, Trader Joe messed up they're converter contract, and allowed someone to steal a lot of money. The details of which are out of scope of this article and can be found in the link attached previously. Anyhow, here I was, with this new-found knowledge of how to exploit fee converters, which by the way are implemented in every DEX out there, and there are a lot. Surely I could find another DEX which the exact same vulnerability.

Spoiler: I didn't. However I did find something interesting in one of the

DEXes called Spookyswap, they actually paid

people to convert fees (LP tokens) into the native token (boo), or rather they paid you to call the

function

that would do so, in exchange giving the caller a percentage (0.1%)

of the value converted. So if you converted 100$ worth of lp tokens, you received 10 cents - its not

much

but

its honest work. If only I could find a way to automate this,

I would be able to make money while sleeping - what else can you want in life right? Well guess what,

Spookyswap

actually provides an already made

python

script

that you can copy and run on your computer. So that's what I did, I copied the code, followed the

instructions,

and ran the script. Again, spoiler: I did not instantly make free money

(big surprise!). At this point it makes sense to add some code in the explanation, so if you don't

understand

solidity feel free to skip, or not! The following is a screenshot of

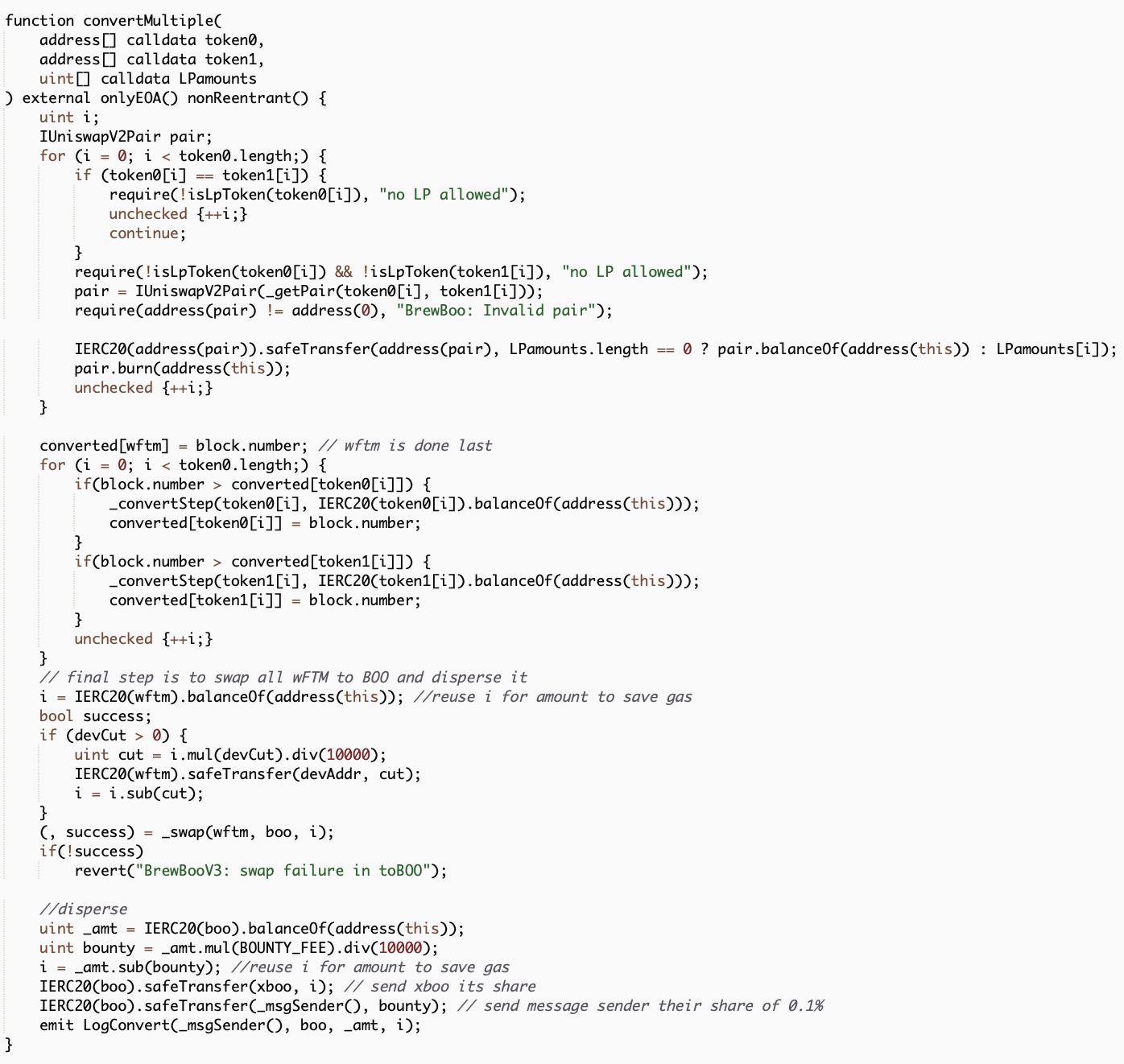

the function you get paid to call.

Looking a little deeper into the code, we see the function expects three arrays as arguments: token0 and token1 which represent the LP tokens, and LPamounts, which represent the amount of each LP to convert. In other words, if I pass the following paramater [ftm, ftm], [eth, usdc], [10, 15], I would convert ten LP tokens of the FTM-ETH pool, and fifteen LP tokens of the FTM-USDC pool. So what exactly did the python script do for me? It encoded an arbitrary list of LP token addresses that it passed as parameters, and simply told the contract to convert however much it had of these LP tokens (this can be done by leaving the amount field blank). Turns out, if you specify an LP token whose balance in the converter contract is 10 cents, which you will make 1/10 of a cent from, you will not be able to cover gas costs with that - REKT. Ok, so we need to be a little smarter than just converting any LP token. How about this, lets loop through the list of LP tokens, probe the converter contract to check what the balance is for each LP token, and if its greater than, say 50$, add it to the array of tokens that we will pass as parameters. That way, if lets say ETH-USDC, ETH-FTM, and ETH-BTC all have 50$ worth of tokens, thats 150$ converted which equals 0.15$ for us, at least enough to cover gas costs (at least on the ftm network which is where all this is happening). If none of the LP tokens had more than 50$ we would not waste money sending unnecessary transactions. Great! Spoiler, once again: didn't work. This time the reason was more nuanced. While my script was busy adding up all the LP tokens that were worth converting, other bots said screw it, I'm converting this LP straight away before anyone else gets it. Hence, by the time my script finished adding all the possible LPs to a list, they had all been converted, leaving 0 left for me to convert. Ok, so the solution should be easy, forget adding up all the LPs into an array, as soon as my script finds one, convert it immediately! You guessed it: fail! But at least this time it was close, another bot frontran me by just 2 seconds! (Below is the failed tx);

At this point I decided it was time to throw in the towel, with more time I might have found a

way

to

detect when the balance of an LP token rose dramatically (ie. listening to the events of big swaps as

those

generate the fees), but I was too tired and sick of the stupid converter contract that I decided to call

it

a

day.

Overall the experience was definetely a lot fun, even watching other bots steal my well deserved

fees

was

kind of cool in a way. Will close this off with the cliche - see u in the mempool anon...